1.

The ingredients included in a manufactured food product are referred to as raw materials and as the product's

direct materials.

2.

The wages of employees working on a manufacturer's assembly line are part of the product cost known as

direct labor.

3.

A manufactured product has three inventoriable costs: direct materials, direct labor, and manufacturing or factory

overhead.

4.

The term associated with estimated, predetermined product costs is

standard costs.

5.

Manufacturers have the cost of their inventories in several general ledger accounts. One of the accounts is sometimes described as Stores. Which of the following inventories would be in the Stores account?

6.

The general supplies used in the manufacturing process are part of

7.

The difference between the actual cost of a product's inputs and the standard cost of one of the product's inputs is known as a

variance.

8.

The standard cost of direct materials is the cost the manufacturer should have used to make the good output.

9.

The variance that indicates the difference between the amount of direct materials that should have been used to make the good output and the amount of direct materials actually used is the direct materials

usage (or quantity or efficiency) variance.

10.

Which of the following terms would NOT be considered a price variance in a standard cost system?

11.

Which of the following terms would NOT be considered a quantity variance associated with a product's inputs under a standard cost system?

12.

The most advantageous time to recognize the price variance for a product's direct materials is when the materials are put into which of the following inventories?

13.

If the amount of a company's good output is less than the amount required to absorb its fixed manufacturing overhead costs, which variance will be unfavorable?

14.

A company assigns its variable manufacturing overhead to its products on the basis of direct labor hours. The actual direct labor hours exceeded the standard direct labor hours for the products manufactured during the year. Which variable manufacturing overhead variance will disclose the amount of this unfavorable situation?

15.

A company applies or assigns its variable manufacturing overhead costs on the basis of machine hours (MH). The variable manufacturing overhead spending variance is the difference between the actual variable manufacturing overhead costs incurred by the company and .

Actual MH X Actual Variable Manufacturing Overhead Rate

Actual MH X Standard Variable Manufacturing Overhead Rate

Standard MH X Standard Variable Manufacturing Overhead Rate

16.

A company manufactures plastic trays. Its standard cost for the direct material in one tray is 2 pounds at the standard cost of $3 per pound. The company produced 100 trays and used 210 pounds of material. The material's actual cost was $3.10 per pound. The direct materials usage or quantity variance is .

Use the following information in answering Questions 17 – 18:

During a recent accounting period a company produced 1,000 units of Item Q and 400 units of Item R. The standard direct labor is 4 hours for each unit of Item Q and 6 hours for each unit of Item R. The standard cost for one hour of direct labor is $20 per hour. The actual direct labor for the accounting period was 6,500 hours at $19 per hour.

17.

Which of the following is the direct labor efficiency variance for the accounting period?

18.

Which of the following is the direct labor rate variance for the accounting period?

Use the following information in answering Questions 19-20:

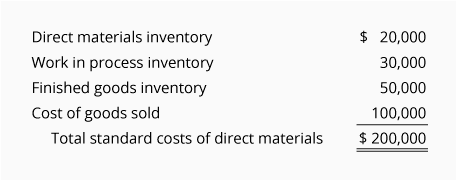

The direct materials price variance for the recent accounting period is $8,000 unfavorable. The direct material associated with this variance had a standard cost of $200,000. At the end of the accounting year, the standard cost of the direct material is residing in the following:

19.

Assuming that the unfavorable variance of $8,000 is a significant (material) amount for this company, how much of the variance would be charged to the finished goods inventory?

20.

Assuming that the unfavorable variance of $8,000 is an insignificant (immaterial) amount for this company, what is the maximum amount of the variance that can be charged to the cost of goods sold?