1.

After the payments in an ordinary annuity have been discounted to time period 0, you will have the __________

present value of the ordinary annuity.

2.

__________

Compound interest is referred to as interest on interest.

3.

The interest removed from the payments in an ordinary annuity when calculating the present value is also referred to as __________

discount.

4.

In the calculation of present values, the payment amounts that are discounted are not accrual accounting amounts; rather they are __________

cash amounts.

5.

If the cash amount of a transaction is not known, accountants will record the transaction at the fair

value of the property or services exchanged. If neither amount is available, the accountant will record the transaction at the

value of the future cash amounts.

6.

Under the accrual basis of accounting, when should the discount on notes receivable should be reported as interest revenue?

When The Note Is Received

Over The Life Of The Note

7.

Under the accrual basis of accounting, the discount on notes payable should be reported as interest __________

expense over the life of the note.

8.

If you know the present value, the recurring payment amount, and length of the annuity, you can calculate the __________

interest rate by using a present value of an ordinary annuity factor.

9.

Which of the following present value of an ordinary annuity (PVOA) factors are larger?

10.

You can determine the number of payments (n) in an ordinary annuity, if you know the amount of each payment, the present value of the annuity, and the __________

interest rate.

11.

Company X received a promissory note from Corp Y. The note does not specify any interest and it requires Corp Y to pay $3,000 at the end of each year for four years. Which interest rate should Company X use to discount the note receivable to its present value?

Borrowing Rate Of Company X

12.

A present value of an ordinary annuity table is used to compute the present value of a five-year ordinary annuity with a payment occurring every three months. If the company has a time value of money of 12% per year, compounded quarterly, the number of periods (n) to be used in the calculation is

__________

20.

5 years times 4 quarters per year

and the interest rate is

__________

3%.

12% divided by 4 quarters per year

.

13.

A present value of an ordinary annuity (PVOA) table is used to compute the amount of a single deposit to be made today into an account earning interest of 6% per year compounded monthly. The deposit must be sufficient to cover a withdrawal of an identical amount each month for 10 years. At the end of the 10 years, the balance in the account should be $0. When using the PVOA Table to solve for the amount needed (the present value), the number of periods (n) is

__________

120.

10 years times 12 months per year

and the interest rate per period is

__________

0.5%.

6% divided by 12 months per year

.

Use the following information for answering Questions 14 – 18.

Company X’s accounting year ends on December 31 of each year. On December 31, 2024 Company X received a promissory note from Corp Y in exchange for services provided by Company X. The fair market value of the services is not known and the fair market value of the note is not known. The note calls for two payments of $10,000 each: one on December 31, 2025 and one on December 31, 2026. No interest is specified in the note. Company X computed the present value of the note to be $17,000 as of December 31, 2024.

14.

The amount of service revenue that Company X should report in 2024 is $__________

$17,000.

15.

The amount of interest revenue that Company X should report in 2024 is $__________

None.

16.

The carrying value of the note at December 31, 2024 is $__________

$17,000.

Face amount of $20,000 minus the discount of $3,000..

17.

The amount of interest revenue that Company X should report in 2025, if it amortizes the discount on notes receivable by using the straight-line method is $__________

$1,500.

$3,000 of discount divided by 2 years..

18.

If the $3,000 of discount is a significant amount in light of Company X's net income and other financial information, the __________

effective interest rate method of amortization should be used.

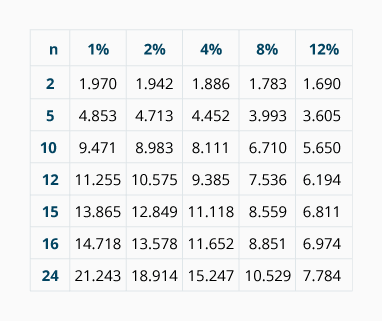

Use the following present value of an ordinary annuity factors for solving the remaining questions:

19.

Assuming the time value of money is 8% compounded annually, the present value on January 1, 2025 of a $1,000 cash amount occurring on January 1 of each of the years 2026, 2027, 2028, 2029, and 2030 is $__________

$3,993.

(PVOA factor for n=5; i=8%) times $1,000.

20.

Assuming the time value of money is 8% per year compounded quarterly, the present value on December 31, 2024 of a $1,000 cash amount occurring on March 31, June 30, September 30, and December 31 of each of the years 2025, 2026, 2027, and 2028 is $__________

$13,578.

(PVOA factor for n = 16; i = 2%) times $1,000.

21.

Assuming the time value of money is 12% per year compounded monthly, the present value on January 1, 2025 of a $1,000 cash amount occurring on the last day of each month of 2025 is $__________

$11,255.

(PVOA factor for n = 12; i = 1%) times $1,000.

22.

As of January 1, 2025, a non-interest bearing note has a present value of $5,650. The note requires ten payments of $1,000 each to be made on December 31 of each year beginning on December 31, 2025. The interest rate used to calculate the present value was

__________

12%.

Go to the row, n = 10, and search that row until you find a factor close to 5.650 ($5,650 divided by $1,000). The factor 5.650 appears in the 12% column.

% compounded

.

23.

A fund earning 8% per year compounded annually has a balance of $8,559 as of January 1, 2025. The owner of the fund wishes to withdraw $1,000 on December 31 of each year starting on December 31, 2025. The number of withdrawals that can be made before the fund reaches a $0 balance is

__________

15.

Go to the 8% column and search for the factor 8.559 ($8,559 divided by $1,000). The factor appears in the row where n = 15.

. The last withdrawal will occur on December 31,

.

24.

The answers to PVOA calculations can often be verified by preparing an __________

amortization schedule, which shows the amount of interest and principal contained in each payment.