1.

A future amount that has been discounted to time period 0 becomes a

present value.

2.

Interest earned on interest is referred to as the

compounding of interest.

3.

The name associated with the amount removed from a future value when discounting it to the present value is

interest.

4.

In the calculation of present values, the future amounts that are discounted are not accrual accounting amounts; rather they are future

cash amounts.

5.

If the cash amount of a transaction is not known, accountants will record the transaction at the fair

value of the property or services exchanged. If neither amount is available, the accountant will record the transaction at the

value of the future cash amounts.

6.

Under the accrual basis of accounting, when should the discount on notes receivable be reported as interest revenue?

When The Note Is Received

Over The Life Of The Note

7.

Under the accrual basis of accounting, the discount on notes payable should be reported as interest expense .

When The Note Is Received

Over The Life Of The Note

8.

If you know the present value, future value, and length of time before the future amount will occur, you can compute the

interest rate by using a present value calculation.

9.

Which present value factor is larger: the PV of 1 factor for 10% or the PV of 1 factor for 12%?

10.

You can determine the number of periods (n) in a present value calculation, if you know the future amount, the present value, and the

interest rate.

11.

Company X received a promissory note from Corp Y. The note does not specify any interest and it will be due in three years. Which interest rate should Company X use to discount this note receivable to its present value?

Borrowing Rate Of Company X

12.

A present value of 1 table is used to compute the present value of a single amount occurring in five years. If the company has a time value of money of 12% per year compounded quarterly, the number of periods (n) to be used in the calculation is

20.

5 years times 4 quarters per year

and the interest rate is

3%.

12% divided by 4 quarters per year

.

13.

A present value of 1 table is used to compute the amount of a single deposit to be made today into an account earning interest of 6% per year compounded monthly. The deposit will remain in the account for 10 years. At the end of the 10 years, the account balance needs to be $100,000. To solve for the present value, the number of periods (n) is

120.

10 years times 12 months per year

and the interest rate per period is

0.5%.

6% divided by 12 months per year

.

Use the following information for answering Questions 14 – 18:

Company X’s accounting year ends on December 31 of each year. On December 31, 2025 Company X received a promissory note from Corp. Y in exchange for services provided by Company X. The fair market value of the services is not known and the fair market value of the note is not known. The note is for $20,000 and it is due on December 31, 2027. No interest is specified in the note. Company X computed the present value of the note to be $16,000 as of December 31, 2025.

14.

The amount of service revenue that Company X should report in 2025 is $

$16,000

Face amount of $20,000 minus the discount of $4,000..

15.

The amount of interest revenue that Company X should report in 2025 is $

None.

16.

The carrying value of the note at December 31, 2025 is $

$16,000

Face amount of $20,000 minus the discount of $4,000.

17.

The amount of interest revenue that Company X should report in 2026, if it amortizes the discount on notes receivable by using the straight-line method is $

$2,000

Discount of $4,000 divided by 2 years..

18.

If the $4,000 of discount is a significant amount in light of Company X's net income and other financial information, the

effective interest rate method of amortization should be used.

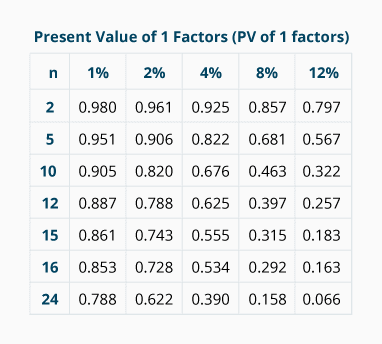

Use the following present value of 1 factors for solving the remaining questions:

19.

Assuming the time value of money is 8% compounded annually, the present value on January 1, 2026 of a $1,000 cash amount occurring on December 31, 2030 is $

$681.

(PV of 1 factor for n = 5; i = 8%) times $1,000.

20.

Assuming the time value of money is 8% per year compounded quarterly, the present value on December 31, 2025 of a $1,000 cash amount occurring on December 31, 2029 is $

$728.

(PV of 1 factor for n = 16; i = 2%) times $1,000.

21.

Assuming the time value of money is 12% per year compounded monthly, the present value on January 1, 2026 of a $1,000 cash amount occurring on December 31, 2027 is $

$788.

(PV of 1 factor for n = 24; i = 1%) times $1,000.

22.

A non-interest bearing note of $1,000 due in ten years has a present value of $322. The interest rate used to calculate the present value was

12%.

Go to the row, n = 10, and search that row until you find a factor close to 0.322 ($322 divided by $1,000). The factor 0.322 appears in the 12% column.

% compounded

.

23.

The length of time required for an investment of $463 on December 31, 2025 to become $1,000 if the investment earns 8% compounded annually is

10.

Go to the 8% column and search for the factor 0.463 ($463 divided by $1,000). The factor appears in the row where n = 10. years.