Certified Management Accountant (CMA)

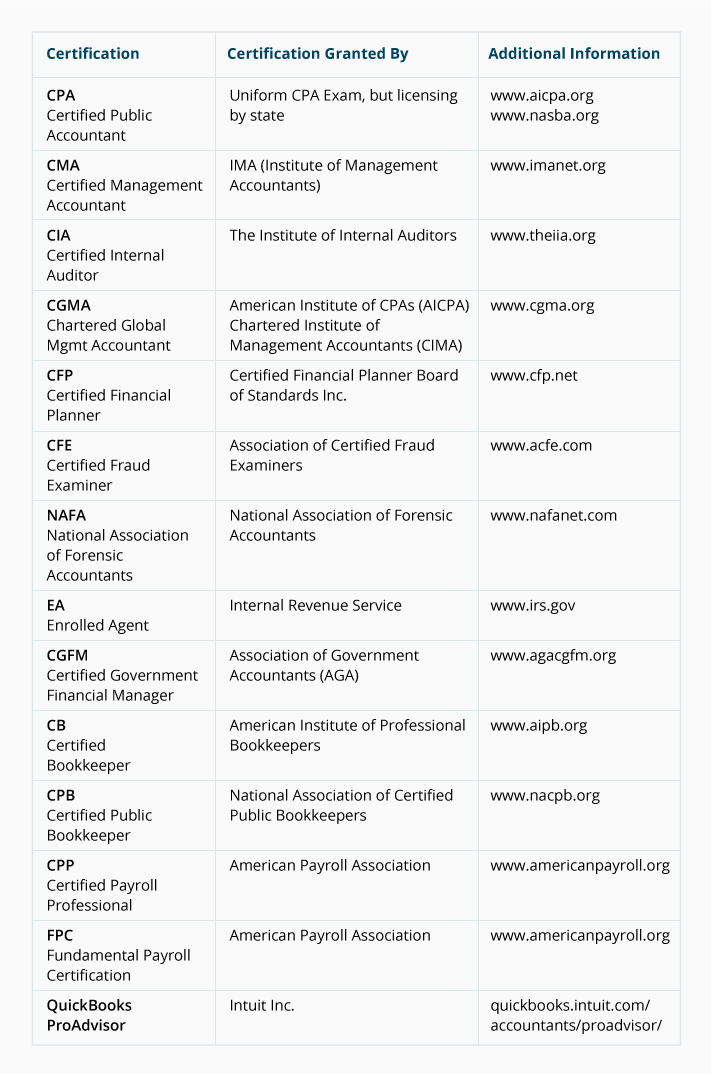

After you’ve become an accountant, you may choose to go on to earn a specialized certification, license, or other credential in accounting. Doing so puts you a notch above uncredentialed accountants and may open up additional job opportunities for you.

We discussed the certified public accountant (CPA) designation in some detail at CPA Requirements and CPA Exam. Whether or not you choose to pursue a CPA designation, you might be interested in pursuing the certified management accountant designation, or CMA.

To become a CMA, you must meet the education and experience requirements and pass the CMA Exam. Information on the CMA Exam is available at www.imanet.org.

Passing the CMA Exam demonstrates that you have a strong proficiency in management accounting and financial management. The time you spend reviewing and learning the material covered on the CMA Exam will make you a better accountant.

Preparing for the CMA Exam will make you a better management accountant if you are already working in industry. If you are working for a CPA firm as a public accountant, you will also become a more knowledgeable CPA. Since most accountants will eventually work in areas outside of public accounting, the CMA credential is a wise investment.

CMA Exam Review Courses and Materials

There are several sources for CMA review courses and materials. Here is an alphabetical listing with links to their websites: