For multiple-choice and true/false questions, simply press or click on what you think is the correct answer. For fill-in-the-blank questions, press or click on the blank space provided.

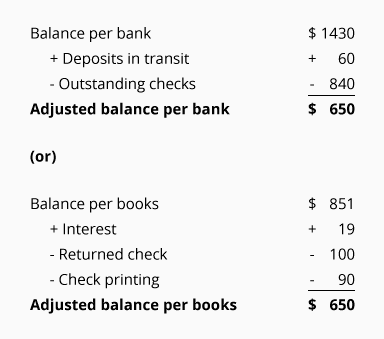

If you have difficulty answering the following questions, learn more about this topic by reading our Bank Reconciliation (Explanation).

For items 4-15, select the action necessary to reconcile the bank statement.

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

Add

To

BOOK

Balance

Deduct

From

BOOK

Balance

Add

To

BANK

Balance

Deduct

From

BANK

Balance

.

. Bank Service Charge

Deposit In Transit

Bank Error

Check Printing Charge

Outstanding Checks

Fee For NSF Check

Decrease By $9

Increase By $9

None Needed

Decrease By $9

Increase By $9

None Needed

Get Our Premium Bank Reconciliation Test Questions When You Join PRO

Receive instant access to our entire collection of premium materials, including our 1,800+ test questions.

View All PRO Features

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Read all 3,033 reviewsFeatures

PRO

PRO Plus

Read 3,033 Testimonials