Definition of Customer Deposit

A customer deposit could be money that a company received from a customer prior to the company earning it. (The company had not yet provided the customer with the associated goods or services.) In other words, the company received the asset Cash and has the obligation to provide the goods or services to the customer or to return the money. Hence, the current liability account Customer Deposits is credited. When the company earns the deposit amount, Customer Deposits will be debited and Sales Revenues will be credited.

A customer deposit could also refer to the money a bank received from a depositor. Since the bank has not earned this money, the amount is recorded by the bank with a debit to its asset account Cash and a credit to the bank’s liability account Customer Deposits.

Example of Customer Deposit

Let’s assume that Ace Manufacturing Inc. agrees to produce an expensive, custom-made machine for one of its customers. Ace requires that the customer pay $50,000 before Ace begins to design and construct the machine. The $50,000 payment is made in December 2024 and the machine must be finished by March 31, 2025. The $50,000 is a down payment toward the machine’s price of $400,000.

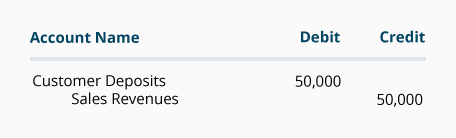

In December 2024 Ace will debit Cash for $50,000 and will credit Customer Deposits, a current liability account. When the machine is completed in 2025, Ace will debit Customer Deposits for $50,000 and will credit Sales Revenues for $50,000.

Let’s break down the above customer deposit example step by step.

December 2024

Ace Manufacturing Inc. receives a $50,000 down payment from the customer.

January – March 2025

Ace designs and constructs the custom-made machine.

March 2025

Ace completes the custom-made machine by March 31, 2024, as agreed.