For multiple-choice and true/false questions, simply press or click on what you think is the correct answer. For fill-in-the-blank questions, press or click on the blank space provided.

If you have difficulty answering the following questions, learn more about this topic by reading our Inventory and Cost of Goods Sold (Explanation).

FIFO

LIFO

Average

FIFO

LIFO

Average

FIFO

LIFO

Average

Cost

Sales Value

Periodic

Perpetual

FIFO

LIFO

Average

FIFO

LIFO

Average

LIFO Periodic

LIFO Perpetual

Neither

Use the following information for questions 9 – 14:

A company purchased merchandise at increasing costs during the year 2024. The purchases were made at the following costs…

The company sold 10 items at the end of each month.

$1,380

$1,386

$1,400

$1,460

$1,380

$1,386

$1,410

$1,460

$1,386

$1,410

$1,416

$1,460

$1,386

$1,410

$1,416

$1,460

$1,386

$1,410

$1,416

$1,460

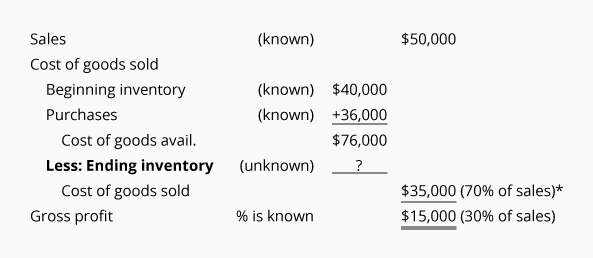

$26,000

$35,000

$41,000

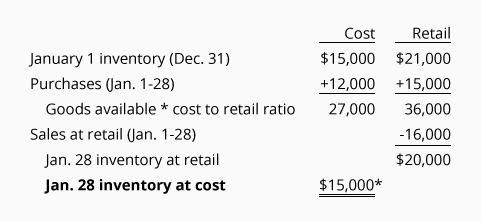

$15,000

$16,000

$20,000

Too High

Too Low

Unaffected

True

False

Get Our Premium Inventory and Cost of Goods Sold Test Questions When You Join PRO

Receive instant access to our entire collection of premium materials, including our 1,800+ test questions.

View All PRO Features

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Read all 2,930 reviewsFeatures

PRO

PRO Plus

Read 2,930 Testimonials