For multiple-choice and true/false questions, simply press or click on what you think is the correct answer. For fill-in-the-blank questions, press or click on the blank space provided.

If you have difficulty answering the following questions, learn more about this topic by reading our Cash Flow Statement (Explanation).

For all questions assume that the indirect method is used.

There are four parts to the statement of cash flows (or cash flow statement):

For items 1-18, indicate which part will be affected.

Depreciation Expense.

Operating

Investing

Financing

Supplemental

Proceeds from the sale of equipment used in the business.

Operating

Investing

Financing

Supplemental

The Loss on the Sale of Equipment in Question #2.

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

Operating

Investing

Financing

Supplemental

For items 19 – 30 indicate whether they will have a positive or negative EFFECT ON CASH.

A positive effect could also be thought of as a source of cash, an increase in cash, or a positive amount on the cash flow statement.

A negative effect could also be thought of as a use of cash, a decrease in cash, or a negative amount on the cash flow statement.

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

Positive

Negative

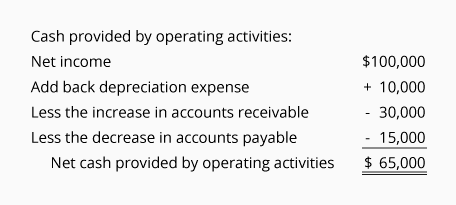

$65,000

$125,000

$155,000

$225,000

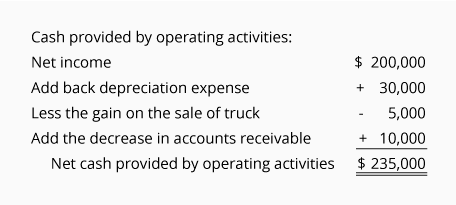

$235,000

$253,000

$3,000

$8,000

$13,000

Get Our Premium Cash Flow Statement Test Questions When You Join PRO

Receive instant access to our entire collection of premium materials, including our 1,800+ test questions.

View All PRO Features

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Read all 3,033 reviewsFeatures

PRO

PRO Plus

Read 3,033 Testimonials